Current Funding Environment

IU Health (Aa2/AA/AA), AdventHealth (Aa2/NR/AA), Banner Health (NR/AA-/AA-), and Arkansas Children’s Hospital (A1/AA-/NR) came to market this week with structures ranging from long-term fixed rate to put bonds (5 – 10 year) to variable rate demand bonds. Reports are that all transactions went well, including IU Health’s 30-year tranche offered as a 5.00% coupon to yield 4.25% (+75) and Arkansas Children’s 30-year tranche offered at 5.25% to yield 4.35% (+85). Meanwhile, a range of factors offer the prospect for continued rate volatility throughout 2023:

- The June 7 Wall Street Journal reported that more than $1 trillion of Treasury securities will be offered between now and the end of September 2023, including approximately $850 billion that was delayed while the 2023 debt-ceiling deal was being negotiated.

- At its meeting next week, the Fed is expected to pause on rate actions to let markets catch their breath and offer space to assess conflicting indicators ranging from tightening bank credit (economy slowing) to sustained jobs strength (economy expanding).

|

1 Year |

5 Year |

10 Year |

30 Year |

|

|

June 9—UST |

5.20% |

3.92% |

3.74% |

3.88% |

|

v. May 26 |

-8 bps |

-4 bps |

-9 bps |

-10 bps |

|

June 9 –-MMD* |

3.07% |

2.66% |

2.59% |

3.50% |

|

v. May 26 |

-24 bps |

-17 bps |

-13 bps |

-12 bps |

|

June 9—MMD/UST |

59.04% |

67.86% |

69.25% |

90.21% |

|

v. May 26 |

-3.65% |

-3.61% |

-1.77% |

-0.75% |

|

*Note: MMD assumes 5.00% coupon |

||||

SIFMA reset this week at 2.84%, which is approximately 54% of 1-Month LIBOR and represents a -57 basis point adjustment versus the May 24, 2023, reset.

The Debt Ceiling Deal

An agreement to suspend the $31.4 trillion debt ceiling was reached on June 2. Who knows if an actual default was imminent or if, instead, we were facing a long summer of market chaos, TSA lines, shuttered national parks, and the host of disruptive to damaging things that accompany partial government shutdowns. At times like this I imagine news anchors being engaged in some secret competition to see who can push the hyperbole farthest and best capture the spirit of Ron Burgundy. But any way you look at it, the agreement to suspend the $31.4 trillion debt ceiling until January 2025 takes one big headache off the table.

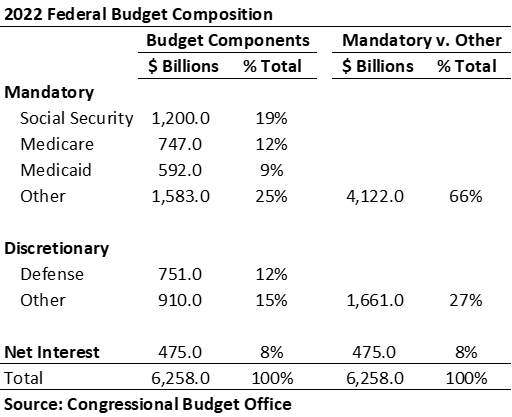

The federal budget is comprised of three main buckets: mandatory spending for programs that are not subject to annual appropriations; discretionary spending for agencies and programs that are subject to annual appropriations; and net interest on publicly held debt. According to the Congressional Budget Office (CBO), the FY 2022 budget includes approximately $6.3 trillion in outlays, of which $4.1 trillion are mandatory, $751 billion are for discretionary defense, $910 billion are non-defense discretionary, and $475 billion are interest on publicly held national debt. Given federal revenues of $4.9 trillion, this level of spending generates a $1.4 trillion deficit, which represents 5.5% of forecasted GDP (versus an average deficit-to-GDP of 3.6% over the past 50 years).

The 2023 debt ceiling agreement holds non-defense discretionary spending flat in FY 2023 with a 1.0% increase in FY 2024. That’s it. The CBO had earlier estimated that given current funding patterns, federal spending is on pace to reach $9.8 trillion (25% of forecasted GDP) by 2033 and debt held by the public is on pace to exceed $45 billion (118% of forecasted GDP) over the same period. The big drivers are material increases in Social Security and Medicare as America ages but also an increase in net interest costs from $475 billion to $1.4 trillion (which is roughly double current defense spending). CBO scoring suggests the 2023 debt ceiling agreement should generate around $1.3 trillion in savings over a decade, which isn’t meaningful relative to the scale of anticipated expenditures.

All this confirms that the greatest threat to healthcare’s financial and credit foundation remains the federal government’s role as lead payer. Other important pressure points include state fiscal health and the specter of recession (which may work differently if continued hiring translates into a “full-employment recession”). But the big resource engine is the federal government, and its current budget construct isn’t sustainable. Congress can pull one or some combination of three levers: restructure programs—including mandatory programs—to reduce cost; raise taxes; or tolerate escalating debt. So far, debt has been the entire answer and it is hard to imagine a world where our political leaders step hard into the necessary work of restructuring popular programs or materially increasing taxes. Rationalizing U.S. spending will be more disruptive if left until some future tipping point, but no matter the pace, timing, or mix of options, any solution is likely to mean constrained resources for healthcare.

The urgency of this post-COVID inflationary moment is to right-size operations in pursuit of operating cash flow sufficient to both generate internal capital and facilitate access to external capital. But federal budget realities suggest this is more than an immediate issue—it is likely to define healthcare’s experience for the foreseeable future. And the parallel imperative to operational restructuring is to:

- Understand whether your organization has the balance sheet resources needed to create a bridge across the transformation.

- If yes, ensure those resources are in their most helpful form and that they are positioned or utilized in ways that directly support the operating transition.

- If no, understand the partnering strategies that can secure access to the necessary resources.

High stress moments—healthcare’s constant since March 2020—highlight that success is about total resource management. You might think that you can or should focus solely on operational performance improvement, but the probabilities of corporate success deteriorate when balance sheet isn’t managed on a parallel track—you need a financial plan to drive operations and a fully connected and integrated resource allocation plan to drive balance sheet. Credit pressures are most likely to emerge when operating stress is paired with a weak (or weakening) balance sheet or one that is improperly positioned. The healthcare financial management game is relentless and changing fast, and the response must be tight integration across operations and balance sheet.