Well-resourced competitors to hospitals and health systems are aggressively using consumer-focused strategies to gain a foothold in the industry. Providers that integrate consumer insights throughout their operations will be best positioned to compete moving forward.

Over the course of the last decade, the idea that healthcare providers need to be more consumer-centric has gradually become conventional wisdom. This change in mindset started slowly in the wake of the Affordable Care Act and gathered significant momentum in the wake of the COVID-19 pandemic, as providers rapidly added new consumer-centric services or expanded existing ones.

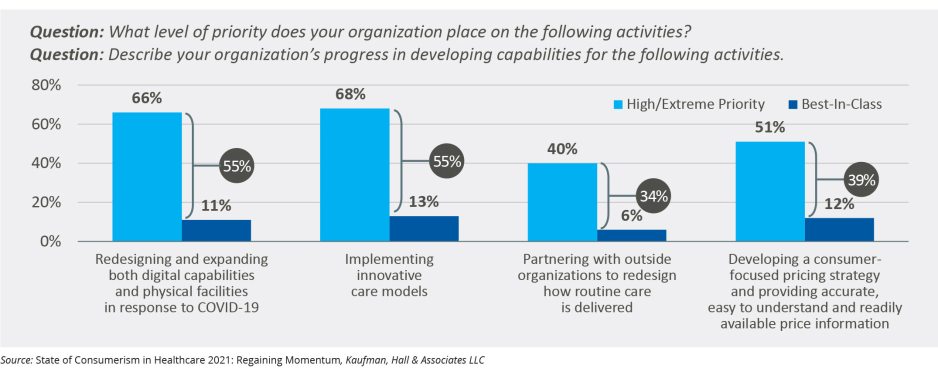

As of 2021, 66% of providers surveyed in Kaufman Hall’s State of Consumerism in Healthcare report said they considered it a high priority to redesign and expand digital capabilities and physical facilities (Figure 1). However, only 11% of respondents said their organizations were currently best in class in those capabilities—leaving providers with a considerable opportunity for improvement.

Figure 1. Organizations Consider Consumer-Centric Initiatives High Priority, Yet Lack Supporting Capabilities

And as healthcare organizations continue their efforts to embrace consumer-focused operating models, there are clear examples to learn from, both inside and outside of healthcare—from retailers like Walmart and CVS to large technology companies like Amazon to new entrants including Oscar and OneMedical. These companies reveal important lessons about customer segmentation and improving the healthcare experience that are relevant to incumbent healthcare providers. Still, the question remains as to why the healthcare industry has been slow to integrate consumer-centric principles relative to other industries.

There are numerous reasons why a rapid transformation into a consumer-focused, digital-first enterprise is a unique challenge for most hospitals and health systems. For starters, hospitals are community-based, mission-driven organizations that must treat every patient that visits their emergency room. And in the wake of the COVID-19 pandemic and other societal shifts, many organizations are increasing their commitment to addressing the racial and social inequities that contribute to disparities in healthcare outcomes.

But while healthcare providers can’t meet their missions by emulating every move of their new competitors, they also can no longer truly serve their missions without systematically integrating consumer insights and principles throughout their organization.

Integrating the Consumer: A Practical Approach

Every aspect of a health system’s activities, from board and leadership to strategic decision-making to frontline care, can and should include the consumer perspective. But healthcare organizations cannot wait for a years-long transformation that will provide the ideal strategy, data, and infrastructure to implement the ideal consumer-centric plan. Instead, organizations must begin their efforts to integrate the consumer into their thinking and actions with practical, concrete steps. The list below includes some of the steps providers can take immediately to elevate the consumer perspective as a priority throughout their organizations.

Management/Governance:

- Selecting board members with backgrounds in consumer businesses, such as retail and hospitality

- Granting authority to a C-suite executive that leads and/or provides oversight for consumer insights activities, and represents the consumer voice in leadership discussions and decision-making

- Developing and organizing consumer insights functions and creating clear leadership and linkages from consumer insights to strategy, value-based care, pricing, operations, and marketing

Strategy:

- Ensuring the voice of the consumer is explicitly considered in strategic financial planning

- Using customized and fit-for-purpose consumer insights to set organizational priorities and inform key strategic decisions

Value-Based Care:

- Segmenting consumers by lines of business, health needs and behaviors to support the growth of covered lives within a value-based model

- Tailoring patient engagement approaches based on an understanding of the specific consumer segment, or an individual’s specific needs and likely behaviors

Pricing:

- Identifying the level of consumer shopping activation in market, and the trade-offs consumers make between brand, access, and price

- Developing transparency strategies that reflect both compliance with federal and state regulations and the identification and understanding of patients’ needs and pain points throughout their care journey

Operations:

- Incorporating a consumer lens and expanding the definition of “access improvement”

- Redefining the patient experience to consider the entire consumer journey and revenue cycle, from the identification of initial needs to clinical encounters to billing and payment, and the time in-between specific consumer needs for an organization’s services

- Developing care models that are reflective of consumer expectations in both the acute care and physician practice setting—and developing partnerships with payers and other providers to advance those efforts

Marketing:

- Informing digital communication and engagement strategies with external consumer insights

- Tailoring communication with different consumer segments to meet specific needs, attitudes, and behaviors

What are Consumer Insights?While insight into consumer behavior is sometimes mischaracterized as mere “common sense,” there is an entire discipline and science focused on generating and using consumer insights to drive strategy and decision-making.

Eliciting these insights requires more than simply processing survey data or consumer feedback. While those inputs are important, a sophisticated approach requiring expertise and experience is required to integrate that information with other data points and knowledge—including clinical and business insights.

Consumer insights should be developed from both qualitative and quantitative methods—including surveys, focus groups, interviews, ethnographies, and other techniques—to listen to consumers, obtain data and use it to inform priorities, strategies, and tactical decisions.

Quantitative research methods generate data that can be discretely organized and analyzed to produce numerical results.

Example: Consumer surveys to determine how many people are shopping for healthcare services based on price

Qualitative research methods generate perspectives that fill in gaps where numerical data is not practical or fails to capture the human element.

Example: Individual consumer interviews to understand nuances of the patient journey for cancer care |

Figure 2. Integrating the Consumer

Getting Started and Sustaining Transformation

Integrating the voice of the consumer throughout a healthcare organization (Figure 2) is not an overnight proposition. And embarking on organizational transformation requires a disciplined approach that breaks down what can sometimes feel like an overwhelming exercise into a series of practical steps, while also effectively using available resources. Ultimately, by developing consumer insights and steadily elevating the consumer voice throughout their operations, healthcare organizations can adopt consumer-centric principles and build respectful, sustainable relationships with the individuals they serve.